oregon tax payment system

Payment is coordinated through your financial institution and they may charge a fee for this service. Your browser appears to have cookies disabled.

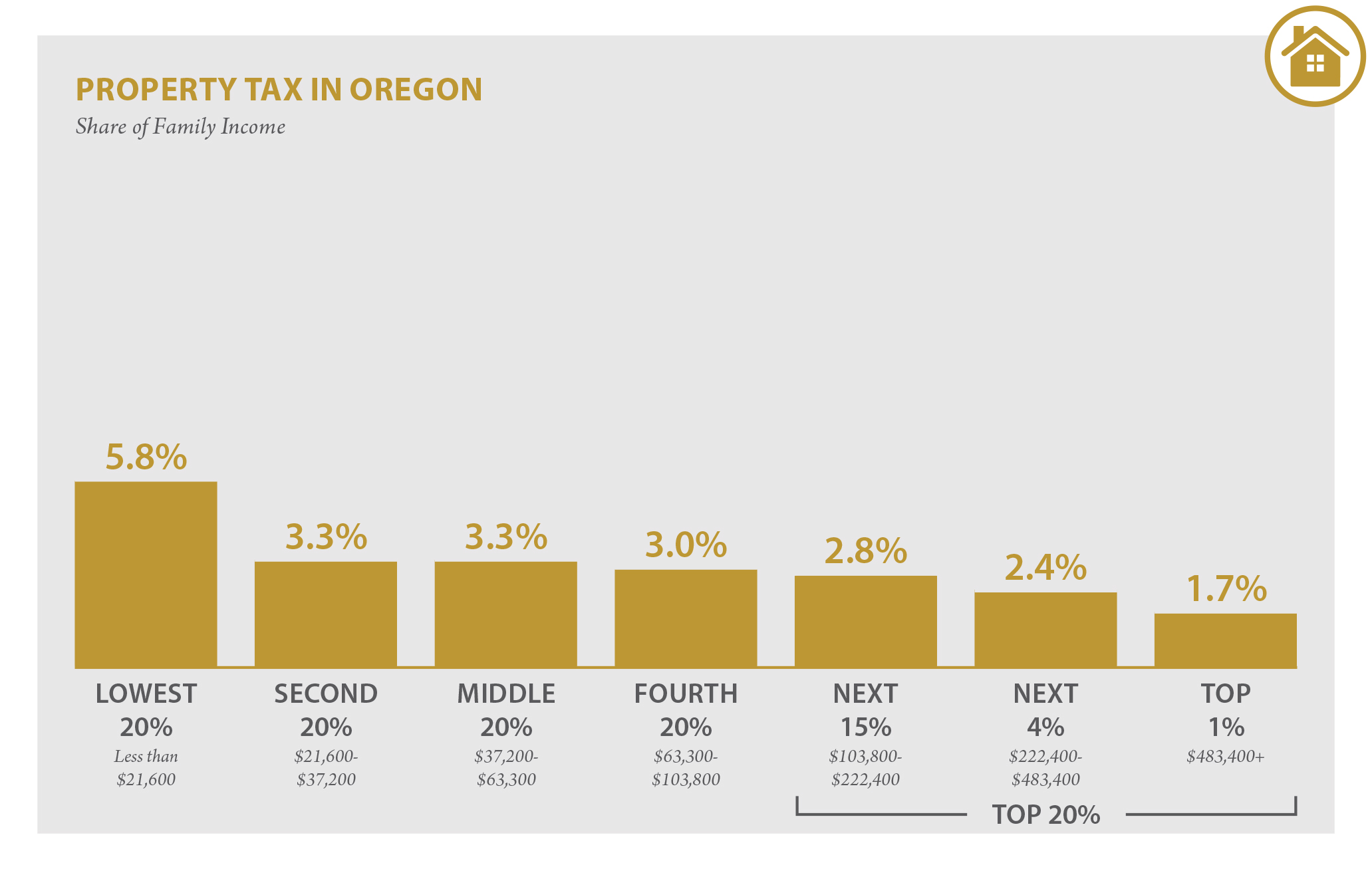

Oregon Who Pays 6th Edition Itep

Oregon tax payment system Thursday 17 March 2022 Edit.

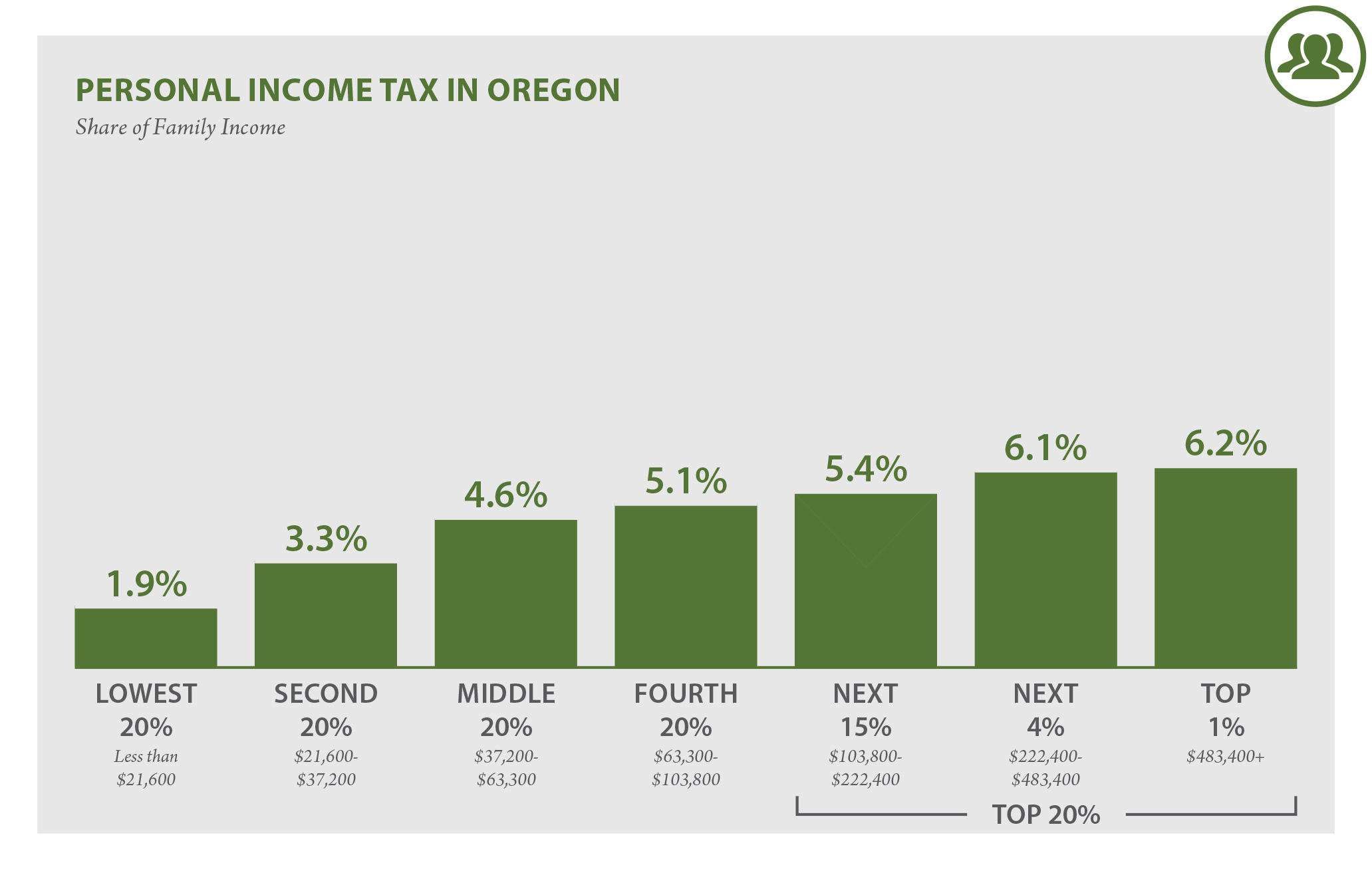

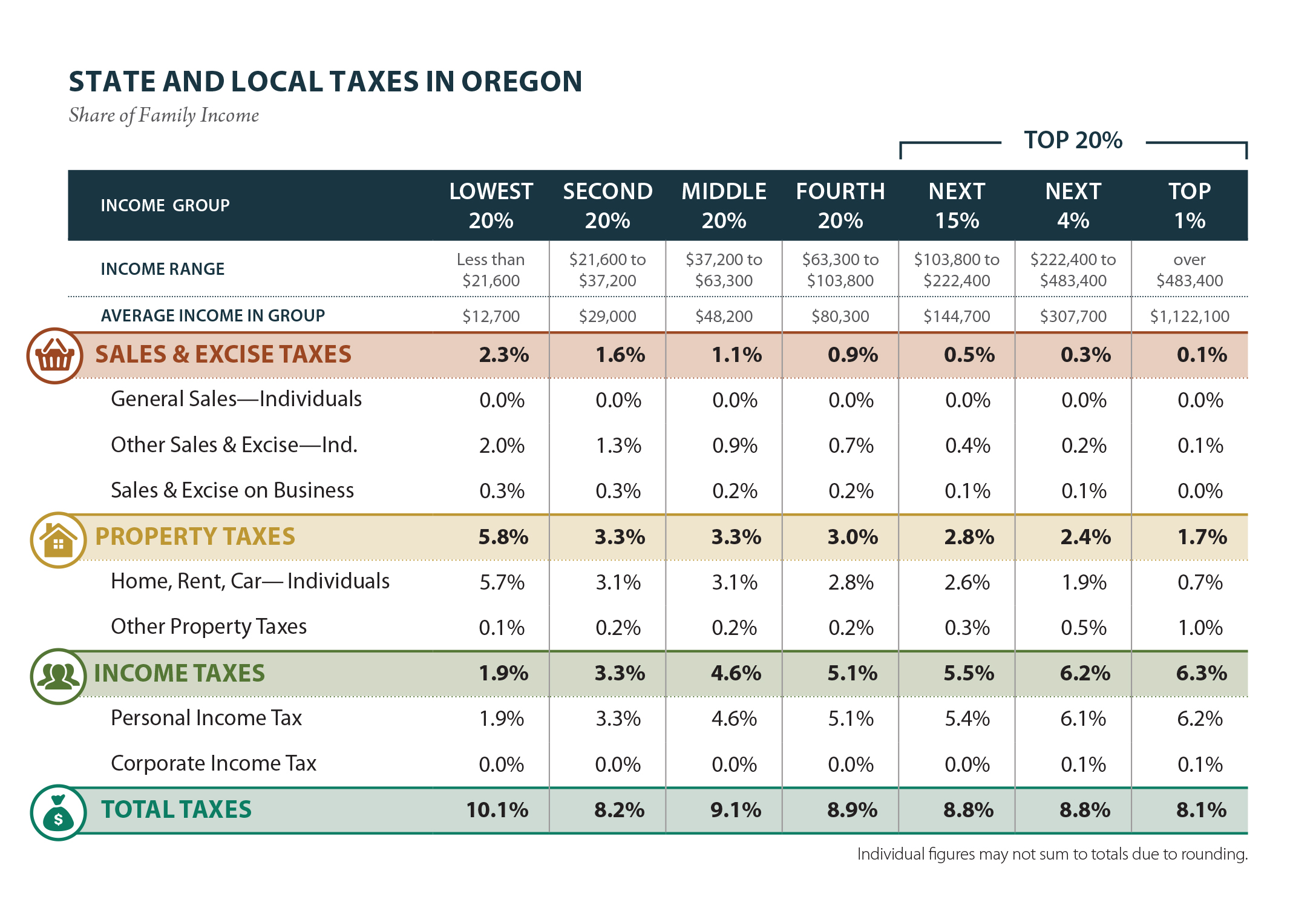

. Oregons personal income tax is mildly progressive. Below we have highlighted a number of tax rates ranks and measures detailing Oregons income tax business tax sales tax and property tax systems. The Oregon Small Business Development Center Network.

The links below have been provided for your convenience. Line 14 is the Oregon Excise tax OR-20-INS paid for the tax year. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

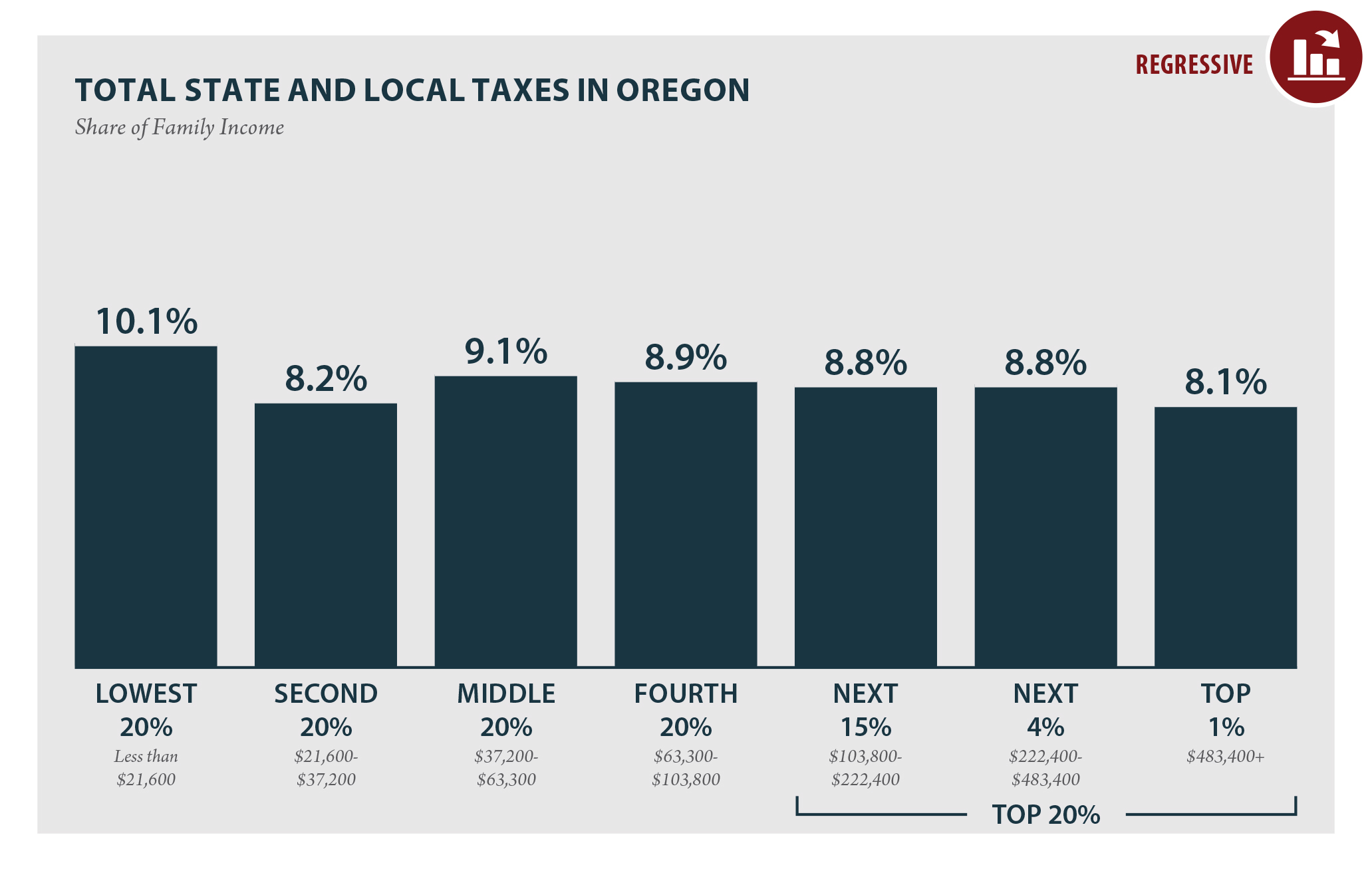

From Jesus to Adam Smith there is wide agreement that a fair tax system is one based on the ability to pay asking for a bigger share of a rich persons income than a poor persons. UI Payroll Taxes. OPRS is a reporting system only.

Oregons property tax system is defined by two significant constitutional limitations that were put in place by initiative petitions passed by voters in November 1990 and May 1997. Any questions you have about the payment systems will need to be directed to them. Find approved tax preparation services.

The first thing to know about the state of Oregons tax system is that it includes no sales tax. Cookies are required to use this site. Oregon Department of Revenue.

The payment system is managed by Department of Revenue. Including Unemployment Insurance tax and Paid Family and Medical Leave Insurance PFMLI contributions Workers Benefit Fund WBF State Tax. These benefits are funded by State Unemployment Tax Act SUTA payroll taxes paid by employers as well as reimbursements from governmental and non-profit employers.

How does Oregon rank. You may now close this window. You must pay your Oregon combined payroll and corporate excise or income taxes through EFT if you are federally mandated to use the Electronic Federal Tax Payment System EFTPS.

You can make ACH debit payments through this system at any time with or. The entire tax system is not. We found that English is the preferred language on Oregoneft pages.

Everything you need to file and pay your Oregon taxes. The first step towards understanding Oregons tax code is knowing the basics. It is not a payment system.

Be advised that this payment application has been recently updated. Click Here to Start Over. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes.

The lower of the Maximum Assessed Value MAV or Real. This means that neither state nor local authorities collect taxes on the sale of products or services. You have successfully logged out of the Oregon Department of Revenue Tax Payment System.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers. Free tax preparation services Learn more.

Frances Online will replace the Oregon Payroll Reporting System OPRS and the Employer Account Access EAA portal beginning with the third quarter filing in 2022. Skip to the main content of the page. Instructions for personal income and business tax tax forms payment options and tax account look up.

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site Revenue Online. Pay the two thirds payment amount on or before November 15 and receive a 2 discount on the amount of current year tax paid. Be advised that this payment application has been recently updated.

In 1997 this measure established a Maximum Assessed Value MAV for each property that existed in 1995. These are the taxes fees etc. You have been successfully logged out.

Oregon Judicial Department Ojd Courts Epay Online Services State Of Oregon Hometown News Madras Central Oregon Daily Oregon S Crazy Income Tax Brackets Editorial Oregonlive Com Where S My Oregon State Tax Refund Oregon Or Tax Brackets. Oregon Tax Payment System Oregon Department of Revenue. Pay the Full Payment amount on or before November 15 and receive a 3 discount on the current years tax amount.

Oregon Tax Payment System. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. Oregons personal income tax.

That your company is being charged by Oregon for the current year and are based on the actual premiums written in Oregon by your company. Instead the state generates revenue with a statewide income tax of 475 to 99 ranking among the highest in the nation. Mail a check or money order.

This requires your input. Thats called a progressive tax system. Regular unemployment insurance UI benefits are paid to eligible people who are unemployed or have had their hours reduced through no fault of their own.

Each states tax code is a multifaceted system with many moving parts and Oregon is no exception. Oregon Tax Payment System Oregon Department of Revenue. Payments can be made using the Department of Revenues site Revenue Online httpsrevenueonlinedororegongovtap_.

EFT Questions and Answers. Skip to Main Content. The new system will support combined payroll reporting.

Electronic funds transfer EFT is an electronic method for moving funds from one account to another. The final one-third payment is due by May 15. EFT transactions are fast and secure.

What Is The Oregon Transit Tax How To File More

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon Who Pays 6th Edition Itep

Metro Supportive Housing Services Tax What It Is Who Pays More

How Do State And Local Individual Income Taxes Work Tax Policy Center

Oregon Who Pays 6th Edition Itep

Oregon Who Pays 6th Edition Itep

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Where S My Oregon State Tax Refund Oregon Or Tax Brackets

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon S Crazy Income Tax Brackets Editorial Oregonlive Com

State Of Oregon Claimant Handbook Section 5 Payments Deductions And Tax Withholding

State Of Oregon Oregon Department Of Revenue Payments

State Of Oregon Blue Book Government Finance State Government

State Of Oregon Blue Book Government Finance Taxes

Where S My Refund Oregon H R Block

Q A How To Navigate The Oregon Corporate Activity Tax

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy